GENEVA, Jan 31 (IPS) — Zero leprosy is not an impossible dream—Yohei Sasakawa, WHO Goodwill Ambassador for Leprosy Elimination at the Global Appeal 2024 to End Stigma and Discrimination Against Persons Affected by LeprosyTuji Sode detached himself from his family and hid himself from the public, embarrassed by his condition, which in biblical times meant exclusion from society and even death.

Sode, a university student in Ethiopia, has Hansen’s Disease, also commonly known as leprosy. Leprosy is a bacterial disease that, left untreated, can cause severe disability and deformity.

Sode recalls the severe discrimination because of his leprosy. He developed a disability because the disease was detected too late for treatment. He admits to having tried different solutions to be cured.

“I did it myself and sought local remedies like holy water,” Sode said in a video message at the launch of the Global Appeal 2024 to End Stigma and Discrimination Against Persons Affected by Leprosy.

“Discrimination restricts our opportunities for education, employment, and marriage, forcing us to detach from our families, lose property, and live a life that depends on begging,” said Sode, who called for global efforts to change the misconception about leprosy and fight entrenched stigmatization and discrimination.

Debilitating Discrimination

Sode’s pain was echoed by Kofi Nyarko, who represents a leprosy information service, IDEA, in Ghana.

“It is very painful,” Nyarko says. “ a disease like leprosy, if you get your treatment, you will be cured, but because of this discrimination against us, the disease affects us for many years, and it is hurting us a lot.”

Nyarko appealed to the World Health Organization (WHO) to help abolish all laws against people affected by leprosy.

Discrimination against people with leprosy continues unabated, reversing efforts to eliminate the disease that crops up in several countries in Asia, Africa, South America, and the United States.

More than 2 million people have leprosy, according to the WHO, and there are 200 000 new cases each year. The resultant discrimination against people affected by leprosy has prevented early detection and treatment, subjecting those affected to a life of hardship, poverty, and isolation. This is the drive behind the launch of the 2024 Global Appeal, calling for an end to “unwarranted discrimination that persons with leprosy continue to face.”

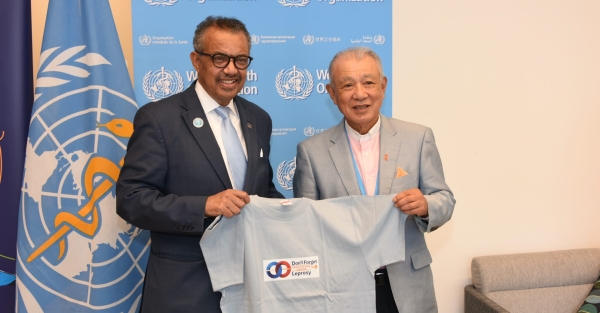

Speaking at the launch of the 2024 appeal, WHO Director General Tedros Adhanom Ghebreyesus said while the world was on track to eliminate the disease, medical interventions were not enough without addressing the conditions in which the disease thrives: discrimination and stigmatization.

“Although it has now been curable for more than 40 years, it still has the power to stigmatize,” Ghebreyesus said, emphasizing that eliminating leprosy requires renewed political commitment, access to services, and awareness-raising.

Ghebreyesus said the global appeal demonstrates a need for renewed commitment to end leprosy by 2030.

While the current WHO Goodwill Ambassador for Leprosy Elimination and the chair of the Nippon Foundation that supports the Sasakawa Leprosy (Hansen’s Disease) Initiative, Yohei Sasakawa, said leprosy was not a curse or a punishment from God but a disease that can be cured by early detection and with raised public awareness.

Sasakawa has committed his life to fighting against the discrimination of people affected by leprosy, visiting more than 120 countries and advocating for zero leprosy.

“Zero leprosy is not an impossible dream,” Sasakawa said in galvanizing global partners to act on eliminating discrimination and securing the rights of persons affected by leprosy.

“I ask for your cooperation so that together we can make the impossible possible,” said Sasakawa, who has pledged to climb Mount Kilimanjaro in Tanzania and hoist a banner at the summit to raise awareness about eliminating discrimination against people affected by leprosy.

The appeal, endorsed by the WHO, was launched with calls for a "world where no one is left behind because of a treatable disease, aiming to break the chains of discrimination and ensure dignity for all." Discrimination is a major drawback to eliminating the transmission of leprosy, a centuries-old bacterial disease that affects the nerves, skin, eyes, and lining of the nose, causing severe disfigurement and disability.

The appeal organized by the Sasakawa Leprosy (Hansen’s Disease) Initiative, is part of its Don’t Forget Leprosy campaign. For nearly 50 years, the Nippon Foundation has worked hand in glove with the WHO to eliminate leprosy. Each year, it receives the support of influential partners from different fields to build solidarity and ensure that its message reaches far and wide.

Maya Ranavare, President of Apal in India, said the discrimination against persons affected by leprosy necessitates a collaborative effort by all, making it imperative for countries to enact laws and policies that acknowledge and address discrimination while involving persons affected by leprosy.

“Countries must also recognise their obligation to prevent third parties from discriminating against persons affected by leprosy as mandated by international and domestic law," Ranavare said.

Deterring Discrimination

Leprosy was officially eliminated in the world as a public health problem in 2000 and in most countries by 2010. The WHO has set global numerical targets that link “elimination” to “interruption of transmission” in its most recent global strategy (2021–2030).

The Tanzania Leprosy Association has been working to end discrimination against persons affected by leprosy and their families, as this has excluded them from participating in economic and social activities.

“The discrimination has contributed to poverty and life hardship,” says Mohamed Mtumbi, Executive Secretary of the Association, noting that community sensitization through education has been the most effective way to change community perceptions about leprosy.

Mozammel Hoq, Secretary of the Rangpur Federation in Bangladesh, appealed to the WHO to ensure all policies formulated for persons affected by leprosy are properly implemented and that the WHO should form a welfare trust for them.

The UN Special Rapporteur on the Elimination of Discrimination Against Persons Affected by Leprosy, Beatriz Miranda-Galarza, highlighted that each year thousands of people, including women, children, and the elderly, face discrimination linked to leprosy. There were disempowering caregiving approaches that perceived people affected by leprosy as passive recipients of care.

“There is a demanding need for the establishment of a support and care system grounded in human rights principles,” Miranda-Galarza said, adding that states, countries, and international organizations must incorporate the fundamental rights of individuals affected to access quality care and support into their policy frameworks.

IPS UN Bureau Report